This is the number one argument I often hear when speaking to Iranian youths internally and it’s diaspora living abroad, while they peak with one eye at Gulf states like Saudi Arabia, UAE, Qatar & Kuwait and wondering, where are our riches? Where is our oil money?

Iran’s crude oil reserves stand at roughly 157 billion barrels which places Iran with the 4th largest oil reserves in the world behind Canada, Saudi Arabia & Venezuela. With 34 trillion cubic meters of gas reserves which places Iran 2nd in the world in gas holdings just behind Russia, it’s clear Iran is rich in natural resources. It should, however, be noted Iran’s natural riches go beyond oil and gas, Iran is very rich in minerals holding nearly 7% of total minerals in the world including the world’s 9th largest copper reserves, 8th largest reserves of iron, 10th largest reserves of uranium, 11th largest reserves of lead as well as other reserves such as iron ore, zinc, silver, manganese, chromium and much more.

When you look at the stats on paper and quickly compare Iran, a Middle Eastern country with other Gulf States, it’s easy to understand why many in Iran are baffled and angry, it makes you wonder where are Iran’s riches? However, as the common saying goes, the devil is in the detail and a close inspection gives an interesting story of the status of Iranian natural resource woes.

As it currently stands, Iran’s total mineral exports (excluding oil & gas) accounts for less than 5% of its entire GDP while holding total mineral reserves worth nearly $1 trillion. Much of this is due to many factors such as ownership (much of the mines are government owned), lack of investment (there is an estimated lack of $30-45 billion investment required in Iran’s mining industry to bring it up to scratch and give it the capability to produce value added by-products), lack of technology and miss management of the mines under government control, and finally the bearish trend of the stock market with many global mineral companies in trouble due to China’s own mineral over production and state subsidy policies.

Iran’s entire mineral exports stands at an estimated $7 billion per year (steel $2.69 billion, iron ore $818 million, copper $662 million, zinc $258 million, lead $220 million etc.) while it’s oil & gas exports is currently $41 billion per year which represented-

Oil: 2.6 million barrels per day export (2.1 million crude and 490,000 condensate) out of 3.9 million barrels produced per day

Gas: 34.8 million cubic meters gas export out of 880 million cubic metres gas production per day (should be noted Iran owed Turkey money due to a legal arbitration case related to gas where Iran overcharged Turkey for gas exports and is paying the est. $2 billion debt with free gas exports)

Current total revenue of raw Iran’s oil, gas & mineral exports stands at an estimated total of $48 billion per year. Iran does also export oil value by-products (petrochemicals) which account for an estimated $10 billion.

Iran’s population stands at an estimated 81.6 million as of 2018 which is a huge growth compared to just under 20 million in 1955 specially if you compare it to some other countries, for example, the UK’s population currently stands at an estimated 66.5 million people in 2018 compared to 51.1 million in 1955!

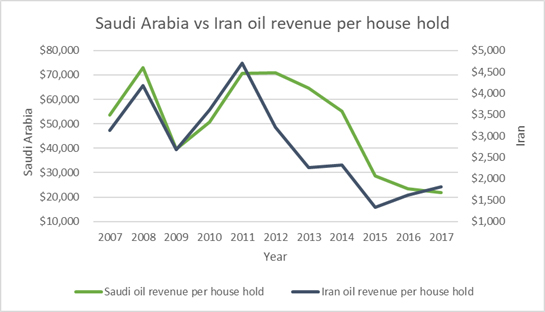

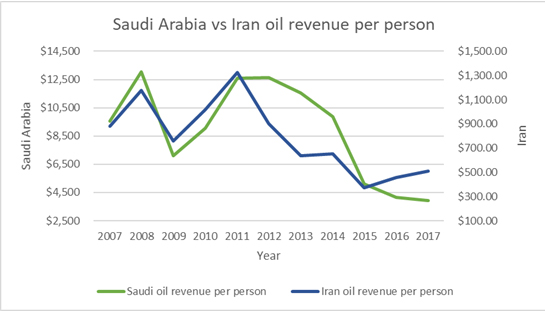

According to the latest census in Iran, there are 3.55 people per household in Iran, therefore dividing Iran’s entire current raw oil, gas & mineral export wealth amongst its population would account for $588 per person or $2,088 per household per year which is quite a different number from the hypothesis of many Iranians who assume they are owed tens of thousands per year from their countries natural resource wealth. The government currently pays Iranians $12 billion in subsidies per year of which $8.37 billion are cash handouts which if paid to every single Iranian equates to $103 per person per year or $364 per family which it’s trying to cut further to combat inflation and to support the poor and vulnerable.

Iran’s sudden population growth, with the added pressures on its oil, gas & mineral industry from its 8 years of war and lack of investment due to sanctions with the small added element of corruption, miss management and some unfriendly/unfavourable terms for foreign investors/buyers has been the biggest factors why Iran isn’t as wealthy as other Gulf states.

Saudi Arabia vs Iran data table:

[wpdatatable id=3]

Saudi Data sources:

https://fred.stlouisfed.org/categories/32805

http://countrymeters.info/en/Saudi_Arabia

https://www.eia.gov/beta/international/analysis_includes/special_topics/OPEC_Revenues/data/real.csv

Iran at its peak in 1974 produced over 6 million barrels of oil per day while Saudi Arabia in the same year was producing 8.4 million barrels. If considerable investment is made in the Iranian oil, gas and mineral sector Iran does have the potential to earn a much greater amount from its natural resources and therefore regain its rightful place in the Middle East as its biggest economy. However, under the current Trump administration’s hawkish anti Iranian political climate, it’s unlikely Iran will be able to achieve its true potential for the foreseeable future.

This article was written as an opinion piece by Zhou Lee, who is an actuarial science graduate from Edinburgh who also holds a degree in political science. The data sources were gathered by Ali Ahmadyar.